Northbeam provides two accounting modes (Cash and Accrual) depending on your organization's needs and preferences

They're named to roughly mirror cash basis vs. accrual accounting in corporate finance. Here are how the two modes are different:

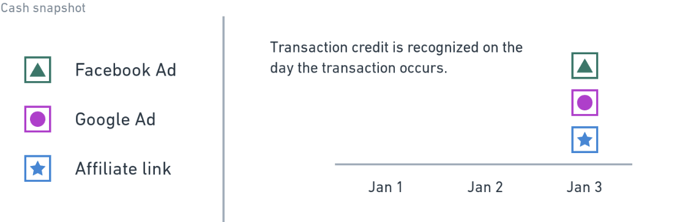

What is Cash Snapshot?

- Revenue and conversion credit is given to the day the transaction occurs.

- Backwards-looking, designed to help you analyze conversion lag

- Useful for understanding the amount of money coming in any given day (cash flows)

- Designed for clients' internal accounting teams to match reporting standards or to ensure Northbeam and your eCommerce store revenue figures are lined up

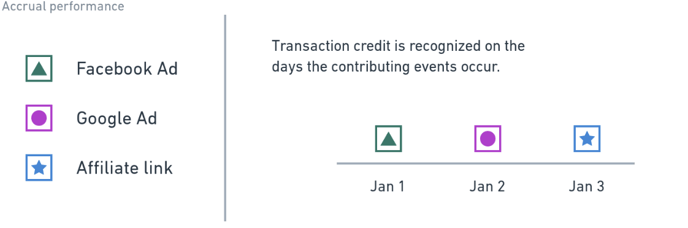

What is Accrual Performance?

- Revenue and conversion credit is given to days that contributing touchpoints occurred

- Forwards-looking, designed to help you forecast revenues using conversion lag

- Useful for understanding the long-range effects of your digital marketing campaigns

- Designed to show the full impact of Northbeam on your business

An example that illustrates the difference between Cash Snapshot and Accrual Performance:

Suppose Dan visits Widgets Co's website on three different days:

- Jan 1 - after clicking on a Facebook Ad

- Jan 2 - after clicking on a Google Ad

- Jan 3 - after clicking on an affiliate link

Dan purchased on Jan 3 $90 worth of widgets from Widgets Co.

For simplicity, let's suppose we're using an equal-weight attribution model, so the Facebook Ad, the Google Ad, and the affiliate link get 1/3 credit for the purchase.

In the Cash Snapshot accounting method, Dan's purchase was recognized on Jan 3. The Cash Snapshot accounting method would report:

- Jan 1

- Facebook Ad - 0 attributed transactions, $0 attributed revenue

- Google Ad - 0 attributed transactions, $0 attributed revenue

- Affiliate link - 0 attributed transactions, $0 attributed revenue

- Jan 2

- Facebook Ad - 0 attributed transactions, $0 attributed revenue

- Google Ad - 0 attributed transactions, $0 attributed revenue

- Affiliate link - 0 attributed transactions, $0 attributed revenue

- Jan 3

-

- Facebook Ad - 0.33 attributed transactions, $30 attributed revenue

-

- Google Ad - 0.33 attributed transactions, $30 attributed revenue

-

- Affiliate link - 0.33 attributed transactions, $30 attributed revenue

In the Accrual performance accounting method, revenue and transactions are recognized on Jan 1, Jan 2, and Jan 3, and they are assigned to the touchpoints that occurred on those days.

The Accrual performance accounting method would report:

- Jan 1

- Facebook Ad - 0.33 attributed transactions, $30 attributed revenue

-

- Google Ad - 0 attributed transactions, $0 attributed revenue

- Affiliate link - 0 attributed transactions, $0 attributed revenue

- Jan 2

- Facebook Ad - 0 attributed transactions, $0 attributed revenue

-

- Google Ad - 0.33 attributed transactions, $30 attributed revenue

-

- Affiliate link - 0 attributed transactions, $0 attributed revenue

- Jan 3

- Facebook Ad - 0 attributed transactions, $0 attributed revenue

- Google Ad - 0 attributed transactions, $0 attributed revenue

-

- Affiliate link - 0.33 attributed transactions, $30 attributed revenue

You might notice while browsing Northbeam that your Accrual performance revenue numbers are smaller than your Cash snapshot revenue numbers, even for the same time period!

Suppose you're looking at Northbeam performance from 2/1 to 2/28. Cash snapshot reports a total Attributed Rev (∞d) of $2.00 M, whereas Accrual performance reports a total Attributed Rev (∞d) of $1.80 M.

How do you interpret this? Where did the missing $200K go?

The $200K that doesn't show up in the February Accrual performance report is from transactions between 2/1 and 2/28 from customers who first visited your website before 2/1. These customers may have first visited in January, December, or even before. If you run an Accrual performance report for those months, this credit will show up as part of the total Attributed Rev (∞d) numbers for that period.